Experts Finally Reveal Their Secret in Getting Your Financial Goals Back on Track

Every year, it’s been a tradition to make some New Year’s resolution to start our year right. One of the most popular decisions most people commit is to save more money while spending less. Most people want to pay out their debts as soon as possible to increase their cash flow.

Then, we want to invest our extra money and let it grow to its maximum potential. While this journey looks promising, it’s easier said than done. You may have followed our goals religiously during the first couple of weeks in January, but most people find themselves already slipped from their resolutions. How can we get our financial goals back on track again? Here’s what the experts have to say.

The Survey

According to LearnVest’ survey, more than four in every 10 Americans give up on fulfilling their financial goals six weeks after the New Year had passed. CompareCards.com also reflected the same results as their survey showed how the Americans lost their priority to pay off their debts first because they’re more concerned with paying their bills.

II.studio/Shutterstock

Most people desire to cut off unnecessary expenses to save and invest more money.

According to CompareCards.com chief analyst, the financial weights most people deal in their everyday lives deviate them from fulfilling their financial resolutions. A separate report conducted by the researchers of Fidelity Investments show 48% of Americans want to save more money, 29% wants to prioritize settling their debts, and the remaining 15% wants to cut down their expenses and spend less money.

Setting The Date

If you’ve already slipped off from accomplishing your financial goals, the experts say it’s okay. There’s no need to reprimand yourself over and over again (which usually discourages you further from accomplishing your goals). Instead, focus on regaining your footing and momentum again. According to them, the secret of having a fresh start is by setting a new date.

Pretty Vectors/Shutterstock

Fulfilling your financial goals doesn’t have to start by January 1. You can set the date whenever you want.

According to Wharton School at the University of Pennsylvania, you shouldn’t limit yourself in making goals only during New Year. The researchers say every day is a new chance for you to accomplish your goals again.

If you can’t find a suitable date, they recommend you think of dates important to you like your birthday, you and your partner’s anniversary, or even essential occasions. Not only this will help you be excited in jumpstarting new habits, but you’ll also be more committed since the dates hold a special place or sentimental value in your heart.

The Fresh Start Effect

According to Wharton professor Katherine Milkman, you can also make the first day of the week as your inspiration to achieve your resolutions if you don’t want to wait for your birthday to come.

PhuShutter/Shutterstock

Schedule your appointed date like an appointment or meeting you can’t miss to commit yourself in accomplishing your financial resolutions.

For example, the Monday effect helps set your momentum for the rest of the week. So if you start saving more money on Monday, chances are, you’ll adopt this mindset for the rest of the week.

Install a Budget App

To further help you in meeting your goals, the financial experts say you need to download and install a budgeting app to help you monitor your cash flow. Since you always bring your phone with you, you can input your expenses on the app to see if it’s suitable for your budget.

It will also prevent you from having impulsive buying since you’ll think twice about depleting your money to buy something you don’t need. You can download apps like Albert, Mint, or PocketGuard to help you monitor your saving and spending habits.

Look for Higher Rates

When we think about saving, the first thing we do is to put all our hard-earned money on the bank. While this seems like a safe method, you might want to think twice if you desire to get higher potential returns. The average interest rate you can get from a bank is less than 1%.

So instead of putting it all on the bank, the experts recommend you put it on investment schemes with higher percentage yield like stocks, mutual funds, or bonds which can give you 2-12% annual return rates.

More in Fame

-

`

Sam Bankman-Fried’s Secret Celebrity Network Exposed

In the glitzy world of cryptocurrencies, where fortunes can be made and lost instantly, having connections to the stars can make...

November 29, 2023 -

`

Are Rare Earth Elements Really So Rare?

When we hear the term “rare earth elements,” our minds often conjure up images of elusive and scarce materials. After all,...

November 20, 2023 -

`

Exploring America’s Top Tier Hotels

For those who crave the finer things in life, the United States offers a treasure trove of luxurious hotels that elevate...

November 19, 2023 -

`

Where Does Elon Musk Live? Let’s Find Out!

Elon Musk, the billionaire entrepreneur and visionary behind Tesla and SpaceX, is known for pushing the boundaries of technology and innovation....

November 10, 2023 -

`

The Origin of Elon Musk’s Feud With Bill Gates

In the world of tech titans and billionaire visionaries, it’s not uncommon for rivalries and feuds to develop. One of the...

November 1, 2023 -

`

Wall Street Downgrade VS. Upgrade: Which One Is Better for Your Money?

“Bad news sells.” It is an age-old adage we have all heard before. In the world of finance, the principle often...

October 28, 2023 -

`

Guitar Smashed By Nirvana’s Kurt Cobain Sells for Nearly $600k!

In the world of rock ‘n’ roll, legends are born from the music and the artifacts left behind. One such artifact,...

October 21, 2023 -

`

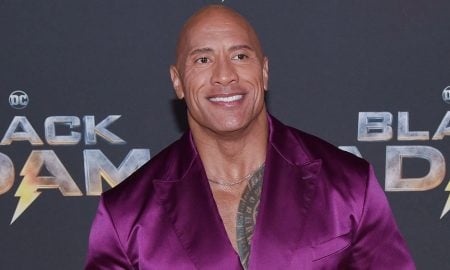

Dwayne “The Rock” Johnson’s Plastic Surgery Journey

Dwayne Johnson, globally celebrated as “The Rock,” is synonymous with wrestling and Hollywood stardom. With a physique chiseled from relentless workouts...

October 10, 2023 -

`

The Most Expensive Things Owned By Brad Pitt

Brad Pitt, one of Hollywood’s most iconic and influential actors, has amassed fame and fortune and an impressive collection of extravagant...

October 3, 2023

You must be logged in to post a comment Login