How To Manage your Finances Like a Pro

One of the main gripes that people tend to have in regards to our school system is the fact that you can go through 16 years of school without ever learning how to survive in the real world. And we are not talking about Bear Grylls surviving. Rather, we are referring to the simple everyday fund management, taxpaying, saving and investing.

Well, we are here to try and help you where the school system has failed. Here is what you can do to make sure that you do not waste your money and that there will always be enough to accommodate your living standards.

pogonici/Shutterstock

Making a budget

Andrey_Popov/Shutterstock

To be efficient with your spending habits, you need to map them out and plan ahead. Therefore, grab a pen, a calculator, and a notebook and start writing everything down (or, more realistically, grab your tablet and type it all in; it is easier). If you are not sure what to write, don’t worry, we got you covered.

Take a month to jot down your expenses. For this month, don’t try to save money or limit yourself, but don’t go around wasting it either, you want to get a realistic sum of money you spend during a month. Do not throw away receipts; Rather, write down how much money you needed in cash and how much was used via credit card. And lastly, write down how much money you have left.

Categorize how much money you spent on individual things. How much went to rent, groceries, gas, and most importantly, how much was spent as discretionary spending. This is the money you didn’t need to spend but simply chose to.

Create your budget for future months. Now that you have the knowledge of the amount of money you need, and the amount of money you spend on things you simply wanted, you can create a spending plan,(a budget if you will). Have columns, and keep it tidy, know how much money you will need for every necessity and try to include savings into it.

Spending your money in a smart way.

pathdoc/Shutterstock

Spending money is inevitable. However, you should do it in a smart way. Here are some tips regarding that:

Renting VS Buying. This one is something that most people overlook. It is the small expenditures that accumulate over time, turning out to be money-burning habits. If you plan to only watch the movie once, do not buy the DVD; rent it. On the flip side, if you believe that you will use the item for a prolonged period, simply do the math to see if it is cheaper to buy said item.

Do not spend the money you still don’t have. This sounds too obvious, but trust us, it is way too easy to start spending in advance if you are low on cash and your paycheck is up next week. It seems too easy to spend some money expecting to cover the cost from your next salary. This is a habit that should be avoided as much as possible.

If you have any debt, get rid of it as soon as possible. The longer you wait, the bigger amount of interest you will pay, and you don’t want that. This one is pretty straight-forward.

jesterpop/Shutterstock

Building your savings.

It may feel a bit excessive to start saving up for “rainy days” as soon as you get a stable job. However, that is exactly what you should do. You will need to have several separate savings, including the ‘rainy day’ fund, retirement savings, and any other savings you might make.

If you can afford it, try saving 15 percent of your earnings. It will accumulate rather quickly and be really handy once it is needed. Having an emergency fund will also be great for every one of those unexpected situations that life tends to throw your way. Let’s imagine you accidentally broke a window that can cost you up to 500 dollars, or your car broke down, which can cost in thousands. You could take a loan to cover that cost, but then you just end up paying an extra 150 dollars for the loan itself. Last, but not least, consult a specialist, be it a financial planner or an advisor.

In the end, the whole point of doing all of this is to provide you with a stress-free life, or at least. Therefore, try it out. If you don’t like it or find it too hard to maintain, try to loosen it up a bit until you feel comfortable in your own financial “skin”.

More in Business Lounge

-

`

Sam Bankman-Fried’s Secret Celebrity Network Exposed

In the glitzy world of cryptocurrencies, where fortunes can be made and lost instantly, having connections to the stars can make...

November 29, 2023 -

`

Are Rare Earth Elements Really So Rare?

When we hear the term “rare earth elements,” our minds often conjure up images of elusive and scarce materials. After all,...

November 20, 2023 -

`

Exploring America’s Top Tier Hotels

For those who crave the finer things in life, the United States offers a treasure trove of luxurious hotels that elevate...

November 19, 2023 -

`

Where Does Elon Musk Live? Let’s Find Out!

Elon Musk, the billionaire entrepreneur and visionary behind Tesla and SpaceX, is known for pushing the boundaries of technology and innovation....

November 10, 2023 -

`

The Origin of Elon Musk’s Feud With Bill Gates

In the world of tech titans and billionaire visionaries, it’s not uncommon for rivalries and feuds to develop. One of the...

November 1, 2023 -

`

Wall Street Downgrade VS. Upgrade: Which One Is Better for Your Money?

“Bad news sells.” It is an age-old adage we have all heard before. In the world of finance, the principle often...

October 28, 2023 -

`

Guitar Smashed By Nirvana’s Kurt Cobain Sells for Nearly $600k!

In the world of rock ‘n’ roll, legends are born from the music and the artifacts left behind. One such artifact,...

October 21, 2023 -

`

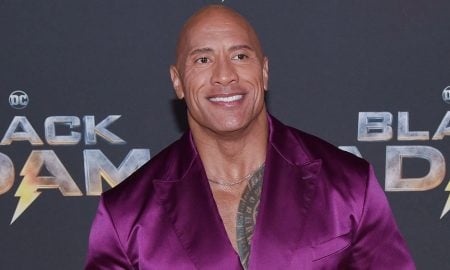

Dwayne “The Rock” Johnson’s Plastic Surgery Journey

Dwayne Johnson, globally celebrated as “The Rock,” is synonymous with wrestling and Hollywood stardom. With a physique chiseled from relentless workouts...

October 10, 2023 -

`

The Most Expensive Things Owned By Brad Pitt

Brad Pitt, one of Hollywood’s most iconic and influential actors, has amassed fame and fortune and an impressive collection of extravagant...

October 3, 2023

You must be logged in to post a comment Login