Never Go Broke Again By Taking These Top Personal Finance Tips to Heart

With the current year coming to a close and people gearing up to welcome a new one, it’s time again to start making various resolutions to better one’s life. This means dealing with the aftermath of the spending spree that the holidays brought, too. Here’s how people can welcome January with better spending and saving habits as they regain control over their personal finances, according to What Investment‘s John Elmore.

Getting Honest

photofriday/Shutterstock

Take note of the inflows and outflows of money in your accounts

First, experts recommend people to be honest with themselves and look at their current situation with regards to money. Going on unaware of where one is finance-wise would only prevent them from actually creating and setting a long-term financial plan in motion. Knowing exactly where one’s money is going will also help them come up with realistic plans.

Become More Disciplined

Of course, awareness alone won’t save one from potential financial ruin. Imposing some form of discipline on one’s self with regards to cash will also keep a person from overspending. One good thing to do is to create a savings pot as a means to motivate themselves into meeting specific milestones whether it’s something big like putting together a deposit for a house or something smaller like a vacation abroad.

Another helpful habit is setting a spending limit on one’s credit cards or decrease the number of times one uses them. Once these have become a habit, one will surely notice positive effects reflected in their finances.

Comparing Before Buying

studioworkstock/Shutterstock

Always look for promos and discounts to save on purchases

Spending can’t be avoided altogether. But when a person does have to splurge on certain purchases, they are recommended to consider all options available to them before paying. Going to comparison sites for car insurance is a good place to start.

Searching for discount codes and sales online for plane tickets is another great money-saving tip. In the end, one would be surprised at just how much they can save just with a few clicks and a few minutes of research.

Getting Thrifty

In connection with the above advice, people are also recommended to practice thrifty habits when doing regular shopping and other routine activities. This means going for deals at the grocery store, reusing wrapping paper for holiday gifts or taking a cheaper route when traveling. All of these may seem small, but the savings they can give a person can add up over time through continuous practice. Some methods may take a little extra effort but will pay off in the end.

Know When to Get Help

Vitalii Matokha/Shutterstock

Reach out to a close friend or a trusted family member to open up about mounting financial worries

Breaking bad habits can’t be done overnight. So, don’t be afraid to ask another person for help or assistance when things get tough. Dealing with financial problems like having debt can actually lead one’s mental health to deteriorate.

More in Fame

-

`

Sam Bankman-Fried’s Secret Celebrity Network Exposed

In the glitzy world of cryptocurrencies, where fortunes can be made and lost instantly, having connections to the stars can make...

November 29, 2023 -

`

Are Rare Earth Elements Really So Rare?

When we hear the term “rare earth elements,” our minds often conjure up images of elusive and scarce materials. After all,...

November 20, 2023 -

`

Exploring America’s Top Tier Hotels

For those who crave the finer things in life, the United States offers a treasure trove of luxurious hotels that elevate...

November 19, 2023 -

`

Where Does Elon Musk Live? Let’s Find Out!

Elon Musk, the billionaire entrepreneur and visionary behind Tesla and SpaceX, is known for pushing the boundaries of technology and innovation....

November 10, 2023 -

`

The Origin of Elon Musk’s Feud With Bill Gates

In the world of tech titans and billionaire visionaries, it’s not uncommon for rivalries and feuds to develop. One of the...

November 1, 2023 -

`

Wall Street Downgrade VS. Upgrade: Which One Is Better for Your Money?

“Bad news sells.” It is an age-old adage we have all heard before. In the world of finance, the principle often...

October 28, 2023 -

`

Guitar Smashed By Nirvana’s Kurt Cobain Sells for Nearly $600k!

In the world of rock ‘n’ roll, legends are born from the music and the artifacts left behind. One such artifact,...

October 21, 2023 -

`

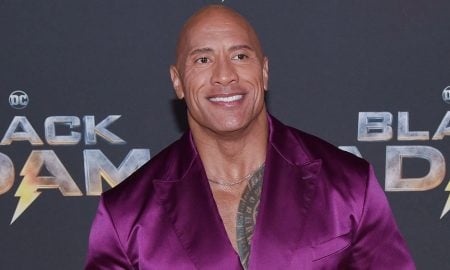

Dwayne “The Rock” Johnson’s Plastic Surgery Journey

Dwayne Johnson, globally celebrated as “The Rock,” is synonymous with wrestling and Hollywood stardom. With a physique chiseled from relentless workouts...

October 10, 2023 -

`

The Most Expensive Things Owned By Brad Pitt

Brad Pitt, one of Hollywood’s most iconic and influential actors, has amassed fame and fortune and an impressive collection of extravagant...

October 3, 2023

You must be logged in to post a comment Login